GET INVOLVED! Stand up for Justice, Do your part, inform others, help others, spread the word, get texted, and be part of the solution. Join us for the change we believe in and support #Ad4justice for a better community at: www.Ad4justice.org #mdyd #africa400 #africa400years #theazks

COVID-19: IRS launches “Get My Payment” Web App to facilitate reception of $1,200 stimulus payment

The U.S. Department of the Treasury and IRS launched, on Weds. April 15, 2020, the “Get My Payment” web application.

The FREE app allows taxpayers who filed their tax return in 2018 or 2019 but did not provide their banking information on either return to submit direct deposit information.

Once they do, they will get their Economic Impact Payments deposited directly in their bank accounts, instead of waiting for a check to arrive in the mail.

“Get My Payment” also allows taxpayers to track the status of their payment. “Get My Payment” is an online app that will display on any desktop, phone or tablet. It does not need to be downloaded from an app store.

For taxpayers to track the status of their payment, they will need to enter basic information in the “Get My Payment”app:

1- Social Security Number

2- Date of birth

3- Mailing address

Taxpayers who want to add their bank account information to speed receipt of their payment will also need to provide the following additional information:

1. Their Adjusted Gross Income from their most recent tax return submitted, either 2019 or 2018

2. The refund or amount owed from their latest filed tax return

3. Bank account type, account and routing numbers

4. Taxpayers are encouraged to gather this information before they enter the portal to save time.

Americans who did not file a tax return in 2018 or 2019 can use “Non-Filers: Enter Payment Info Here” to submit basic personal information to quickly and securely receive their Economic Impact Payments.

Americans who filed 2018 or 2019 tax returns with direct deposit information or receive Social Security do not need to take action.

They will automatically receive payment in their bank accounts. “Get My Payment” cannot update bank account information after an Economic Impact Payment has been scheduled for delivery.

To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS.

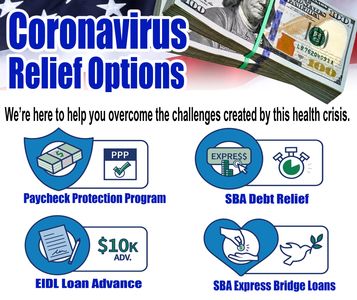

SBA - NEW GRANTS AND LOANS FOR: Small Businesses and Contractors

On June 15, 2020, the SBA announced that they are again opening up the Economic Injury Disaster Loan (EIDL) grant and loan program. This means that independent contractors, sole proprietors, freelancers, and gig workers are eligible to receive a $1,000 grant that does not have to be paid back.

Small businesses and agricultural businesses also may apply for the grant, equal to $1,000 per employee of the business up to a maximum of $10,000.

A loan for favorable terms from the SBA may also be available. There is some uncertainty as to the amount available, but up to $150,000 or $2 million has been reported.

Under the CARES Act passed on March 27, 2020, independent contractors, sole proprietors, gig workers, and freelancers affected by the coronavirus crisis are eligible to receive the grant. The SBA sometimes refers to these grants as “advances,” but you are not required to repay this money to the government.

The application process involves filling out a simple SBA form requesting an Economic Injury Disaster Recovery Loan, which provides for the advance even if the loan is not granted.

Initially, $10 billion was allocated by the government for these grants, but due to the overwhelming amount of applications, the SBA suspended accepting new applications in mid-April 2020 due to a lapse in appropriations for the grants. But now the SBA has lifted the suspension because of legislation passed on April 24, 2020, that allocated another $60 billion for EIDL and grants thereunder.

On June 15, 2020, the SBA announced that they are again opening up the Economic Injury Disaster Loan (EIDL) grant and loan program. This means that independent contractors, sole proprietors, freelancers, and gig workers are eligible to receive a $1,000 grant that does not have to be paid back.

Small businesses and agricultural businesses also may apply for the grant, equal to $1,000 per employee of the business up to a maximum of $10,000.

A loan for favorable terms from the SBA may also be available. There is some uncertainty as to the amount available, but up to $150,000 or $2 million has been reported.

Under the CARES Act passed on March 27, 2020, independent contractors, sole proprietors, gig workers, and freelancers affected by the coronavirus crisis are eligible to receive the grant. The SBA sometimes refers to these grants as “advances,” but you are not required to repay this money to the government.

The application process involves filling out a simple SBA form requesting an Economic Injury Disaster Recovery Loan, which provides for the advance even if the loan is not granted.

Initially, $10 billion was allocated by the government for these grants, but due to the overwhelming amount of applications, the SBA suspended accepting new applications in mid-April 2020 due to a lapse in appropriations for the grants. But now the SBA has lifted the suspension because of legislation passed on April 24, 2020, that allocated another $60 billion for EIDL and grants thereunder.

Who Is Eligible for the Grants?

The SBA disaster loans and grants include the following eligible claimants

Independent contractors (for whom there is expanded eligibility criteria)

● Freelancers

● Sole proprietorships, with or without employees

● Gig workers

● Small businesses with less than 500 employees

● Agricultural businesses

You must have been in business as of January 31, 2020. The grants are available until December 16, 2020, but the SBA will quickly run out of money, so you should apply as soon as possible.

Where Do I Apply Online for the SBA Grant?

The application should be found at covid19relief.sba.gov/#/. Background information from the SBA can be found at www.sba.gov/disaster-assistance/coronavirus-covid-19.

What Advice Is There for Completing the SBA Application If You Are an Independent Contractor?

If you are an independent contractor, freelancer, sole proprietor, or gig worker, here are some tips on filling out the application:

On the first question, check the third box as you are applying as an independent contractor or sole proprietorship.

You must add your Social Security number if you are applying as an individual independent contractor, freelancer, or gig worker.

The form will ask you for the gross revenues for the last 12 months for your independent contractor business and the “cost of goods sold.” You can estimate this based on what happened in 2019. Cost of goods sold means the expenses incurred in the process of providing your product or service as a freelancer, gig worker, or independent contractor.

Where it asks for “Owner” put your name and “100” percent owner.

It will ask for the date the business was established. This is the date you started doing freelance, gig work, or independent contractor work. Just estimate if you don’t have the exact date, but make sure it was before January 31, 2020.

The form will ask for the bank account to which you want the grant money direct deposited. You need the name of your bank, the account number (the middle number at the bottom of your checks), and the routing number (the number at the bottom left of your checks). See the question below on direct depositing.

For your business phone number, it’s okay to give your cell number.

- HOME

- ABOUT US

- FOUNDER OF AD4 JUSTICE

- PHILANTHROPIC WALL

- PROGRAMS

- SHOP

- SUPPORT/DONATION

- PARTNERS & SPONSORS

- COMPLAINTS

- AD4 JUSTICE BROCHURE

- LEGAL REPRESENTATION

- BECOME A MEMBER

- VOLUNTEER APPLICATION

- IDENTITY VALIDATION FORM

- UPCOMING EVENTS

- PAST EVENTS

- AFRICA 400 YEARS.ORG

- CORONAVIRUS (COVID-19)

- GOVERNMENT BENEFITS

- GALLERY

- BLOGS

- VIDEOS

- CONTACT US